Self-employed individuals cannot claim the ERC for their own income as they are not considered employees of their own business. The ERC is designed to support businesses that retained employees during the COVID-19 pandemic, and the credit is determined on wages paid to those employees.

It offers up to $26,000 per employee for those hit by COVID-19.

Even if you didn’t pay taxes in 2020 or 2021, you can still get this credit. It’s based on payroll taxes.

Are you self-employed or a small business owner? You might wonder if you qualify for the ERC. The credit is for employers who saw a big drop in sales or were shut down by COVID-19 orders. Knowing the ERC for self-employed qualification criteria is key to getting the most tax benefits.

To find out if you qualify, read the guide below. If you have questions, ask in the comments at the end.

Don’t wait to claim the credit, as deadlines are coming up in 2024 and 2025. This guide will help you understand the ERC. It will show you how to apply and avoid mistakes. Whether you’re alone in business, a partnership, or a small corporation, knowing about the ERC can save you a lot of money.

Key Takeaways

- The ERC offers up to $26,000 per employee for eligible self-employed individuals and small businesses.

- Eligible wages must have been paid between March 13, 2020, and December 31, 2021.

- Eligibility is based on business impact from COVID-19, including revenue decline or operational suspension.

- Deadlines for claiming the ERC are approaching in 2024 and 2025, so timely action is crucial.

- Understanding ERC qualifications and application processes is key to maximizing tax benefits.

Understanding the Employee Retention Credit (ERC)

The Employee Retention Credit (ERC) is a big help for businesses and self-employed people in the U.S. This erc credit is a big support during tough economic times.

Definition and Purpose of ERC

The ERC tax credit helps businesses keep employees on payroll during the COVID-19 pandemic. It gives a refundable tax credit of 70% of wages paid to eligible employees. This is up to $7,000 per employee per quarter.

Evolution of ERC During the Pandemic

The employee retention tax credit has changed since it started. At first, it covered wages from March 12, 2020, to December 31, 2021. Now, eligible employers can claim up to $26,000 per employee. Self-employed people can claim the credit in 2023, 2024, and 2025.

Key Features for Self-Employed Individuals

Self-employed people have their own rules for ERC. They must have had their business fully or partially shut down by government orders. Or, they must have seen a big drop in gross receipts.

To claim ERC, they need to file Form 7202 on their income tax returns, it is important to note that they cannot claim the ERC for their own wages. Instead, Form 7202 is specifically for claiming credits for leave taken due to COVID-19, not directly for the ERC itself.

For self-employed individuals who employ others, they can claim the ERC for wages paid to those employees using Form 941 or its amended version (Form 941-X)

| Year | Maximum Credit | Percentage of Qualified Wages |

| 2020 | $5,000 per employee annually | 50% |

| 2021 | $7,000 per employee quarterly | 70% |

Knowing these ERC basics is key to getting the most out of it. For more ERC faq, talk to a tax expert or check the IRS guidelines.

Eligibility Criteria for Self-Employed ERC Claims

Knowing the erc qualification rules is key for self-employed folks. The Internal Revenue Service has clear guidelines for who can get the credit.

Qualifying Business Structures

Not every self-employed person can get the Employee Retention Credit. S-Corps and C-Corps with owner payroll might qualify. But freelancers and LLC owners usually don’t unless they have employees.

Revenue Decline Requirements

Businesses need to show a big drop in sales to claim the ERC. In 2020, they had to earn less than 50% of 2019’s quarters. For 2021, it was 20%.

Government Order Impact on Operations

Businesses hit by lockdowns or limits might qualify. This includes if they faced supply chain issues or had to cut back.

| Year | Revenue Decline Threshold | Max Credit Per Employee |

| 2020 | 50% compared to 2019 | $5,000 |

| 2021 | 20% Decline Threshold compared to the same quarter in 2019 or the previous quarter in 2019 (alternative quarter election available) | $7,000 per quarter |

Remember, just being self-employed doesn’t mean you get the ERC. It’s for businesses with employees, not solo owners.

Calculating ERC for Self-Employed

The Employee Retention Credit (ERC) changes based on the year and business size. For self-employed folks, knowing how to figure out this credit is key. It helps them get the most out of it.

In 2020, businesses could get 50% of the first $10,000 in wages per worker. This meant a max of $5,000 per employee. But, in 2021, the rules got better. Now, businesses can get 70% of the first $10,000 in wages per quarter. This adds up to $21,000 per worker each year.

Qualified wages for the Employee Retention Credit (ERC) include cash tips over $20 a month and certain healthcare costs. Small businesses with 100 or under full-time employees in 2020 (& 500 or fewer in 2021) can seek the credit for all wages paid to employees, even if those employees did not work during that time.

But, self-employed folks can’t get ERC. Yet, they might qualify for other COVID tax credits.

| Year | Credit Percentage | Wage Limit | Maximum Credit |

| 2020 | 50% | $10,000 per year | $5,000 per employee |

| 2021 | 70% | $10,000 per quarter | $21,000 per employee |

Self-employed individuals cannot seek the Employee Retention Credit (ERC) for their own wages. However, they may qualify for the Paid Sick and Family Leave Credit, which provides up to $511 per day for sick leave (with a maximum of $5,110 total) if they are unable to work due to COVID-19 related reasons.

For family leave, the credit provides up to $200 per day (with a maximum of $12,000 total). This credit is claimed using Form 7202 on their income tax returns.” This statement accurately reflects the eligibility criteria and details regarding the Paid Sick and Family Leave Credit for self-employed individuals.

Remember, proof is important when claiming these credits. Keep detailed records of payroll costs, taxable income, and any leave payments. This info is vital for filing amended tax returns to claim these credits.

ERC for Self-Employed: Application Process and Deadlines

Getting the Employee Retention Credit (ERC) as a self-employed person needs focus on deadlines and paperwork. You must change your tax return and show you’re eligible.

Required Documentation

You’ll need important documents for your ERC claim. These include payroll records, proof of income drop, and how government orders hit your business. Keep these documents in order to make the application easier.

Filing Amended Tax Returns

To get ERC money back, you must file an updated tax return with IRS Form 941-X. This form lets you fix your payroll tax reports. ERC refunds might take 6 to 9 months because of IRS delays.

Important Dates for 2024 Claims

Remember these key dates:

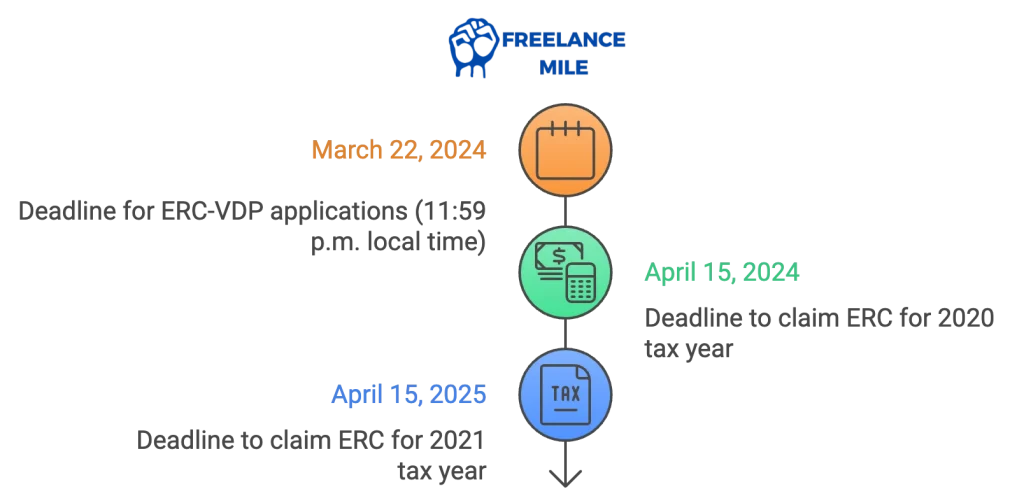

New claims after September 2023 won’t be processed until 2024. Plan ahead to not miss out on credits that could help your taxes and business money.

Potential Pitfalls and IRS Scrutiny

The Employee Retention Credit (ERC) is under the IRS’s watch because of worries about wrong claims. If you’re self-employed or own a business, knowing the risks is key. This helps you avoid big mistakes and legal trouble.

Common Mistakes in ERC Claims

Many employers make mistakes when they claim the ERC. They might not understand the rules, get the wages wrong, or claim credits for PPP loan forgiveness. To steer clear of these errors, talk to a tax expert who knows ERC rules well.

IRS Compliance Reviews

The IRS has stepped up its checks on ERC claims. They’ve found seven warning signs that might mean trouble. Even tax-exempt groups need to be careful, as the IRS is rejecting wrong claims, especially if no wages were paid during the right time.

Withdrawal and Correction Procedures

If you’ve made a mistake with your ERC claim, don’t worry. The IRS has ways to fix or take back claims:

- Withdrawal option for employers who haven’t gotten paid or cashed their check

- Voluntary Disclosure Program lets you pay back 80% of wrong claims by March 22, 2024

- ERC eligibility checklist and tools to help figure out if you qualify

Working with reliable tax pros and knowing the rules well can help you deal with ERC’s complexities. This way, you can avoid IRS trouble.

Conclusion

If you’re self employed or own a small business, knowing about the Employee Retention Credit (ERC) is key. It can help a lot during tough times. The ERC gives credits up to $26,000 per employee for businesses that qualify.

Even though the IRS is checking ERC claims more, you can still get help. This is true for businesses that have kept their employees despite the pandemic.

For those who work for themselves, the ERC rules are different. Independent contractors and 1099 workers usually don’t qualify.

Because it’s complex and mistakes can slow down your credits, getting help from a tax expert is a good idea. They can make sure your claim is right and follows IRS rules.