A few years back, I was staring at my bank account with that familiar sinking feeling. Despite earning decent money as a digital marketer, I couldn’t seem to save more than a few hundred dollars before some unexpected expense would wipe it out completely!

Sound familiar?

If you’ve ever wondered what struggles or victories have you experienced when it comes to managing finances, you’re definitely not alone.

Over my decade-plus career, I’ve learned that saving money is less about how much you earn and more about developing the right systems and mindset.

The good news? I’ve figured out what works (and what doesn’t) through plenty of trial and error.

Let’s check them out!

Key Takeaways

- Emergency fund basics: Start with just $500-$1000 before tackling larger savings goals

- Automation wins: Set up automatic transfers to remove temptation from the equation

- Track spending: You can’t improve what you don’t measure

- Start small: Even $25/week adds up to $1,300 annually

- Address mindset: Your relationship with money impacts every financial decision

The Biggest Money Saving Struggles (And How I Overcame Them)

1. The “I Don’t Earn Enough” Trap

This was my biggest excuse for years! I kept telling myself I’d start saving when I hit the next income milestone.

According to data from PayrollOrg, 78% of Americans said they would find it somewhat or extremely difficult to meet their financial commitments if their paycheck was delayed by just one week.

What changed everything: I started with micro-savings. Just $5 here, $10 there. It sounds ridiculous, but those tiny amounts proved to myself that saving was possible!

2. Lifestyle Inflation Creep

Here’s what nobody warns you about – as your income grows, your expenses tend to grow right alongside it. Got a raise? Suddenly that fancy coffee shop becomes a daily habit instead of a weekend treat.

I fell into this trap hard during my early marketing career. Every client win meant upgrading something – better laptop, 5 star holiday vaccations, more expensive dinners out.

The fix: I implemented the 50/30/20 rule but with a twist. Every time I got a raise, I’d increase my savings rate first before adjusting my lifestyle spending.

3. Emergency Fund Frustration

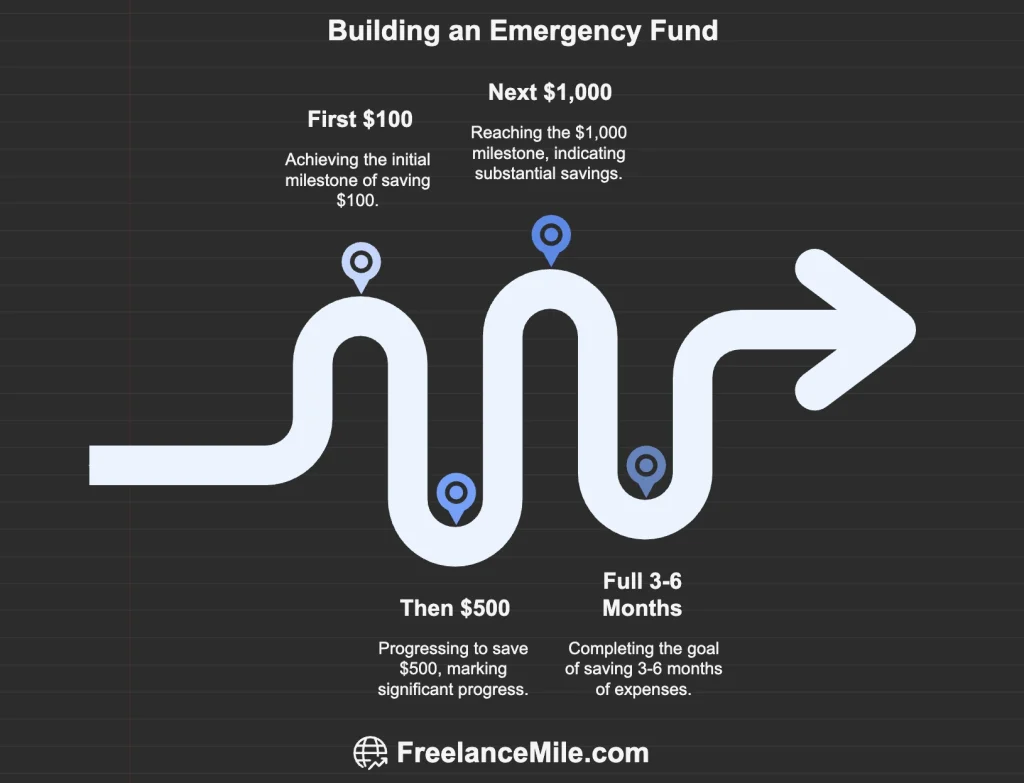

Building an emergency fund felt impossible when I was starting out. The recommended 3-6 months of expenses seemed like climbing Mount Everest!

Breaking it down made all the difference. Instead of focusing on that massive end goal, I aimed for mini-milestones:

Each milestone felt like a genuine victory worth celebrating!

My Biggest Money Saving Victories

1. Automating Everything

This single change transformed my entire financial picture. I set up automatic transfers from checking to savings the day after each paycheck hit.

The psychology behind it: When the money never sits in my checking account, I don’t miss it. Behavioral economics research shows we’re less likely to spend money we don’t see.

Starting amount? Just $50 per paycheck. Within six months, I’d saved over $1,200 without thinking about it!

2. The 24-Hour Rule

Impulse purchases were killing my budget. Amazon one-click ordering was my kryptonite!

So I created a simple rule: wait 24 hours before buying anything over $50 that wasn’t a planned purchase. For bigger items ($200+), I’d wait a full week.

Results were immediate: About 60% of those “must-have” items suddenly didn’t seem so essential after sleeping on it. This one habit probably saves me thousands annually.

3. Finding My Money Motivation

Generic advice like “save for retirement” never motivated me. But saving for specific, exciting goals? Game changer!

My first real savings victory came when I decided to save for a professional camera upgrade. Having that concrete goal with a clear timeline made every small sacrifice feel worthwhile.

Pro tip: Visual reminders work! I kept a photo of that camera as my phone wallpaper.

The Struggles That Still Challenge Me

1. Social Spending Pressure

Let’s be honest – saving money can feel antisocial sometimes. When friends want to hit expensive restaurants or plan costly weekend trips, saying “I’m trying to save money” gets awkward fast.

I’ve learned to suggest alternatives rather than just declining. “How about we cook dinner together instead?” or “I know a great happy hour spot with half-price appetizers!”

The key insight: Real friends will support your financial goals, not pressure you to overspend.

2. Irregular Income Months

As someone in digital marketing, my income can fluctuate. Some months are fantastic, others are lean. This irregularity made consistent saving feel nearly impossible initially.

My solution: I base my savings on my lowest-earning months, not my best ones. When the good months hit, extra money goes straight to savings before I can get used to having it.

3. Technology Temptation

Working in digital marketing means I’m constantly exposed to the latest tools, software, and gadgets. The “it’s a business expense” justification becomes dangerous when you’re not careful!

I now maintain a separate “business upgrade” fund specifically for legitimate work-related purchases. This prevents me from dipping into personal savings or making impulsive decisions.

Victory Strategies That Actually Work in 2025

1. The App Arsenal

Technology can be your savings best friend when used strategically.

Here is one of my go-to tools:

Some others you can also use:

Budgeting: YNAB (You Need A Budget) revolutionized how I think about money allocation.

Automatic Saving: Qapital rounds up purchases and saves the change automatically.

Investment Tracking: Simple, low-cost investing through apps makes growing wealth accessible.

2. The Envelope Method Goes Digital

Remember when people used actual cash envelopes? The concept still works, but I’ve digitized it.

I maintain separate savings accounts for different goals:

- Emergency fund

- Vacation savings

- Home improvement fund

- “Fun money” account

Each serves a specific purpose, preventing me from raiding one fund to pay for something else.

3. Gamifying the Process

Saving money doesn’t have to feel like punishment! I’ve turned it into a personal challenge with rewards along the way.

Monthly challenges I rotate through:

- No-spend weekends

- Meal prep challenges

- Utility bill reduction contests (with myself!)

- DIY project months

Each successful challenge earns me a small reward from my “fun money” envelope.

Common Mistakes That Cost Me Money

1. Perfectionism Paralysis

I used to think I needed the perfect budget, the perfect savings rate, the perfect investment strategy before starting. This perfectionism kept me from starting at all!

Truth bomb: A mediocre plan you actually follow beats a perfect plan you never implement.

2. Ignoring Small Leaks

Those $9.99 monthly subscriptions add up faster than you think! The average American household subscribes to four paid streaming services according to Deloitte’s 2025 Digital Media Trends survey, spending an average of $69 per month, with 47% of consumers feeling they pay too much for the streaming services they use.

I now do quarterly “subscription audits” to cancel anything I’m not actively using.

3. Not Tracking Progress

What gets measured gets managed. For months, I was saving blindly without really knowing if I was making progress toward my goals.

Game changer: Monthly money dates with myself. I review all accounts, celebrate wins, and adjust strategies that aren’t working.

Building Long-Term Saving Success

1. Start With Your Why

Generic savings goals fail because they lack emotional connection. “Save $10,000” means nothing. “Save $10,000 for a down payment on my first home” creates genuine motivation.

My current savings goals:

- Business expansion fund

- Travel adventures account

- Home improvement projects

- Long-term financial independence

Each has a clear purpose and timeline.

2. Automate, Then Optimize

Start with automation, even if the amounts feel tiny. Once the habit is formed, you can gradually increase the amounts.

I started with $50 per paycheck. Now it’s significantly more, but those early months of proving to myself that I could save consistently were crucial.

3. Prepare for Setbacks

Life happens! Car repairs, medical bills, job changes – these aren’t failures, they’re just part of the journey.

The key: Get back on track as soon as possible rather than giving up entirely. One bad month doesn’t erase months of progress.

Looking Ahead: Saving Money in 2025

1. Inflation-Proof Strategies

With ongoing economic uncertainty, traditional saving approaches need updates. High-yield savings accounts are paying better rates than they have in years, but inflation is still eating into purchasing power.

My 2025 approach: Balancing liquid savings with inflation-protected investments for longer-term goals.

2. Side Hustle Integration

The gig economy offers unprecedented opportunities to boost income specifically for savings goals. Even an extra $200-300 monthly can dramatically accelerate your progress.

Pro tip: Treat side hustle income as “found money” that goes straight to savings rather than lifestyle inflation.

3. Community Accountability

Saving money can feel isolating, but it doesn’t have to be. Online communities like Reddit’s r/personalfinance provide support, motivation, and practical advice from people facing similar challenges.

Conclusion

Reflecting on what struggles or victories have you experienced when it comes to saving money reminds me that this journey is deeply personal. Your biggest challenges might be completely different from mine, and that’s perfectly okay!

The struggles – lifestyle inflation, irregular income, social pressure – they’re real and valid. But so are the victories – automated savings, emergency funds, reaching specific goals. Each small win builds momentum for bigger successes.

What matters most is starting somewhere, anywhere, and staying consistent. That first $100 in savings might not seem like much, but it represents something much bigger: proof that you can take control of your financial future.

Remember, saving money isn’t about depriving yourself of everything fun. It’s about making intentional choices that align with your bigger goals and values.

The best part? Once you build these systems and habits, saving money becomes automatic rather than agonizing. You’ll start looking forward to checking your account balances instead of avoiding them!

Stay tuned for my next post!