Last year, I found myself staring at my bank account at 2 AM, wondering where all my money went. Sound familiar?

Despite earning a decent income as a digital marketer for over a decade, I felt like I was constantly playing catch-up with my finances. That’s when it hit me – I had great marketing skills, but my financial planning? Total disaster!

This wake-up call made me dig deep into understanding what financial planning skills ultimately enable an individual to do. The answer completely transformed how I view money and life itself.

Let’s check them out!

Key Takeaways

- Financial planning skills enable individuals to build sustainable wealth and achieve long-term financial security

- These skills provide the power to make confident life decisions without money stress

- Proper financial planning creates opportunities for early retirement and financial independence

- Strong financial skills enable better risk management and protection against unexpected events

- Financial planning ultimately enables individuals to live life on their own terms

What Are Financial Planning Skills Really About?

Before we dive into what these skills can do for you, let’s get clear on what we’re talking about.

Financial planning isn’t just about budgeting (though that’s part of it!). It’s a comprehensive approach to managing your money that includes budgeting, saving, investing, insurance planning, tax strategies, and retirement planning.

Think of it as your financial GPS. Without it, you’re driving around hoping you’ll somehow reach your destination. With it? You’ve got a clear route to where you want to go!

The Consumer Financial Protection Bureau defines financial planning as the process of managing your finances to achieve your personal economic goals.

1. Build Sustainable Wealth That Actually Lasts

Here’s the first life-changing power: financial planning skills enable you to build real, lasting wealth.

I’m not talking about get-rich-quick schemes or hoping your crypto investment moons. I’m talking about systematic, proven wealth-building strategies.

The Compound Interest Magic

When you understand financial planning, you unlock the incredible power of compound interest. Einstein reportedly referred to it the eighth wonder of the world, & honestly? He wasn’t wrong!

Let’s say you start investing $500 monthly at age 25. With an average 7% return, you’d have over $1.3 million by age 65. Start at 35? You’d have about $610,000. That decade makes a $700,000 difference!

Smart Investment Strategies

Financial planning skills teach you about diversification, risk tolerance, and long-term thinking. You learn to invest in index funds, real estate, or other assets that historically gain value over time.

According to Vanguard’s research, a well-diversified portfolio has historically provided steady returns over long periods, despite short-term market volatility.

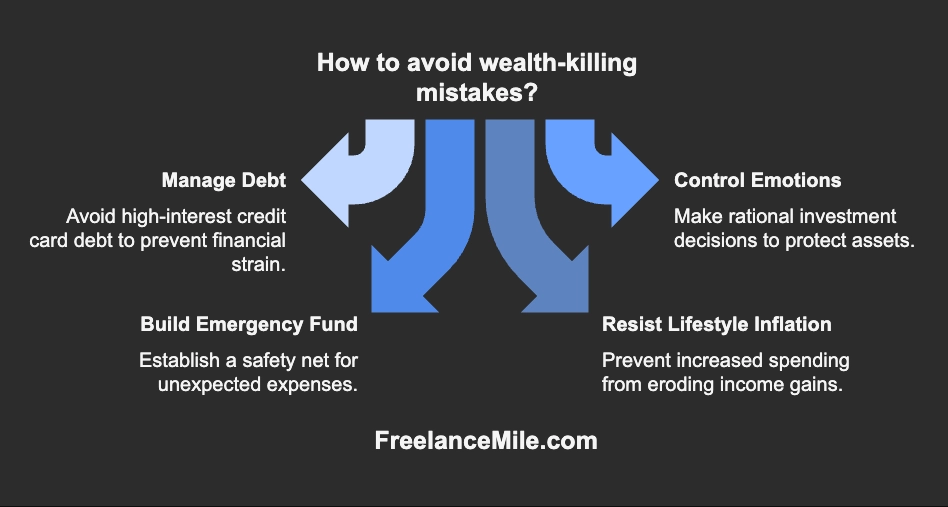

Avoiding Wealth-Killing Mistakes

More importantly, these skills help you avoid the mistakes that destroy wealth. Things like:

2. Gain True Financial Freedom and Independence

This is where things get really exciting! What do financial planning skills ultimately enable an individual to do in terms of freedom? Everything!

The FIRE Movement Connection

Financial planning is the backbone of the FIRE (Financial Independence, Retire Early) movement. People are using these skills to retire in their 30s and 40s!

The concept is simple: save and invest aggressively while keeping expenses low. When your investment returns can cover your living expenses, you’re financially independent.

Freedom to Choose

Financial security gives you choices. Hate your job? You can leave without panicking about next month’s rent.

Want to start a business? You’ve got the financial cushion to take calculated risks.

Dream of traveling the world? Your passive income makes it possible.

Reduced Money Stress

Financial stress is a wide spread issue in the United States, affecting both physical and mental well-being. Strengthening financial planning skills can help manage this stress by increasing predictability and control over debt and expenses.

3. Make Confident Life Decisions Without Money Fears

Remember that 2 AM bank account staring contest I mentioned? Financial planning skills eliminate those moments forever.

Major Life Purchases

When you understand your financial position, buying a house becomes strategic rather than stressful. You know exactly how much you can afford, what down payment makes sense, and how it fits into your long-term plan.

Same goes for cars, education investments, or starting a family. These decisions become calculated moves rather than financial gambles.

Career Flexibility

Strong financial planning enables career pivots. Want to go back to school for that degree you always wanted? Your financial plan makes it possible.

Considering a lower-paying but more fulfilling job? You can model the financial impact and make informed decisions.

Emergency Preparedness

Life throws curveballs. Medical emergencies, job loss, family crises – they happen to everyone.

Financial planning skills help you build robust emergency funds. Most financial experts recommend 3 – 6 months of expenses saved, but your specific situation might require more or less.

4. Create Multiple Income Streams and Opportunities

Here’s something most people don’t realize: financial planning skills naturally lead to income diversification.

Investment Income

As you build your investment portfolio, you create passive income streams. Dividend stocks, rental properties, peer-to-peer lending – these all generate money while you sleep.

Business Opportunities

Understanding finances makes you a better entrepreneur. You can evaluate business opportunities, understand cash flow, and make smart growth decisions.

Many successful business owners credit their financial planning skills as crucial to their success.

Side Hustle Optimization

Financial planning helps you identify the most profitable side hustles and scale them effectively. You understand which opportunities provide the best return on your time investment.

5. Protect Your Family and Legacy

The final life-changing power might be the most important: protection.

Insurance Strategies

Financial planning includes risk management through insurance. Life insurance, disability insurance, umbrella policies – these protect your family’s financial future.

It’s not exciting, but it’s crucial. What happens to your family’s finances if you can’t work? Financial planning addresses these uncomfortable questions.

Estate Planning

Proper financial planning includes estate planning. Wills, trusts, beneficiary designations – these ensure your wealth transfers according to your wishes.

Teaching the Next Generation

When you develop strong financial planning skills, you can teach them to your children. You break cycles of financial struggle and create generational wealth.

The National Endowment for Financial Education found that teens who obtain financial education are more likely to have savings accounts and less likely to max out credit cards.

Getting Started: Your Financial Planning Journey

Feeling motivated but overwhelmed? That’s totally normal!

Start With the Basics

- Track your spending for a month

- Create a simple budget

- Build a $1,000 emergency fund

- Pay off high-interest debt

- Start investing, even if it’s just $50/month

Use Technology to Your Advantage

Apps such as Mint or YNAB (You Need A Budget) make financial planning accessible and automated.

Investment platforms like Vanguard or Fidelity offer low-cost index funds perfect for beginners.

Consider Professional Help

As your situation becomes more complex, consider working with a fee-only financial planner. The National Association of Personal Financial Advisors is able to assist you in finding qualified professionals.

Common Mistakes to Avoid

Let me save you some painful lessons I learned the hard way:

Perfectionism Paralysis

Don’t wait for the “perfect” plan. Start with something simple and improve it over time.

Ignoring Inflation

That $1 million retirement goal? It won’t buy the same lifestyle in 30 years. Factor inflation into your planning.

All-or-Nothing Thinking

You don’t need to save 50% of your income to benefit from financial planning. Even saving 10% consistently makes a huge difference.

Emotional Decision Making

Market crashes happen. Stick to your plan rather than panic-selling or panic-buying.

The Ripple Effects

Here’s what really blew my mind: strong financial planning skills improve every area of your life.

Your relationships improve because money stress decreases. Your health improves because you can afford preventive care and aren’t constantly worried about bills.

Your career accelerates because you can take strategic risks and invest in your education and skills.

You sleep better, laugh more, and live with confidence knowing you’re prepared for whatever life throws at you.

Conclusion

So, what do financial planning skills ultimately enable an individual to do? They enable you to live life on your own terms.

These skills transform you from someone who reacts to financial circumstances into someone who creates their financial destiny. You move from surviving paycheck to paycheck to building sustainable wealth and genuine freedom.

The journey isn’t always easy, but it’s absolutely worth it. Every dollar you save, every investment you make, every financial decision you plan – they’re all building blocks toward the life you actually want to live.

Ready to discover even more ways to take control of your financial future?

I’ve got some incredible strategies coming up that’ll show you exactly how to accelerate your wealth-building journey, even if you’re starting from zero!