The Day My Bank Account Hit Rock Bottom and Changed Everything

When I started working many years back in the digital marketing field, I thought I had everything figured out.

Remote work seemed like the dream setup—no commute, flexible schedule, & the freedom to work from any location.

But it was right after that brutal holiday shopping season during my early career when reality hit hard.

I stared at my bank’s mobile app showing $47.83 in savings, and suddenly that “dream” remote lifestyle felt more like a nightmare.

My laptop had been making weird noises for weeks, and I knew a replacement would cost at least $800.

The panic wasn’t just about being broke—it was about being one emergency away from losing my ability to work entirely.

That rock-bottom moment became the foundation of everything I know about building emergency funds from nothing.

It taught me that most financial advice completely misses the mark when you’re starting with practically zero dollars.

Through years of professional work analyzing consumer behavior and spending patterns, I’ve learned that 37% of Americans can’t cover a $400 emergency expense.

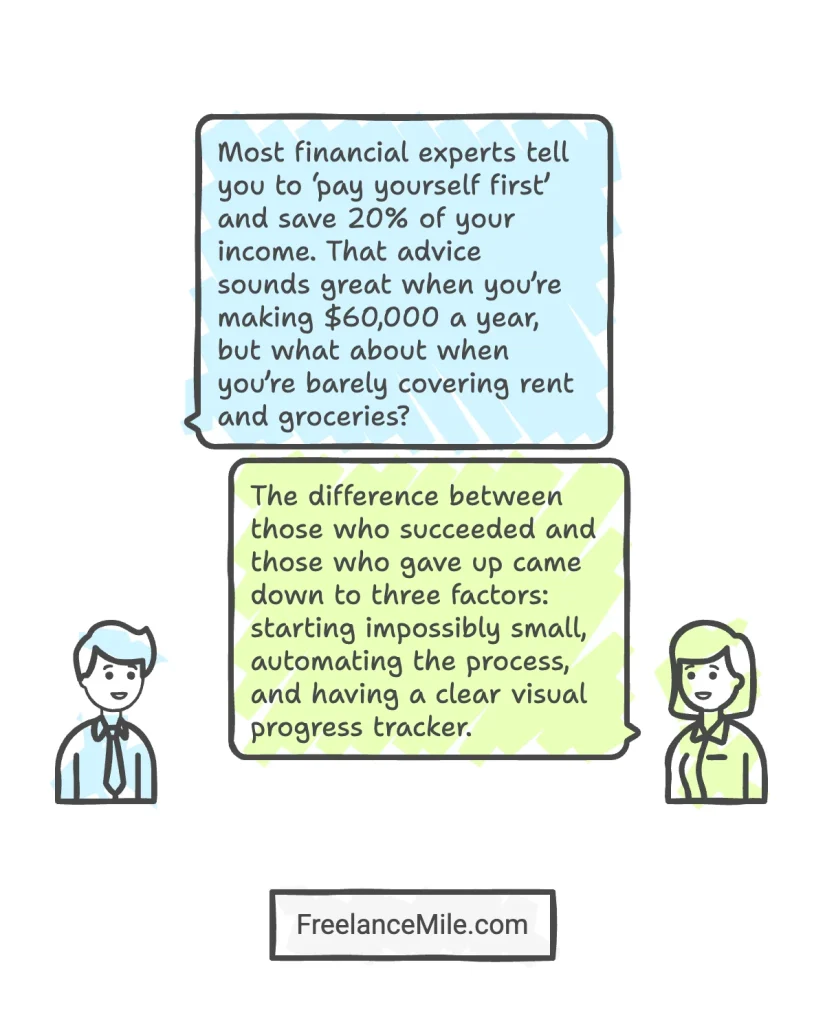

But here’s what most financial advice misses: the psychology behind why traditional saving methods fail when you’re already struggling.

Why Traditional Emergency Fund Advice Fails When You’re Broke

The problem isn’t your willpower or discipline. It’s that traditional advice ignores the reality of living paycheck to paycheck.

When I analyzed spending data from my research into American consumer habits, I found something interesting.

People who successfully built emergency funds while broke didn’t follow the standard rules—they created their own system based on their actual circumstances, not some idealized budget.

The $1000 Challenge: Your Step-by-Step Roadmap

Building your first emergency fund when you’re broke requires a completely different approach. You can’t rely on cutting your $5 Starbucks habit when you’re already drinking gas station coffee to save money.

Instead, you need a system that works with your current reality while gradually building toward financial stability.

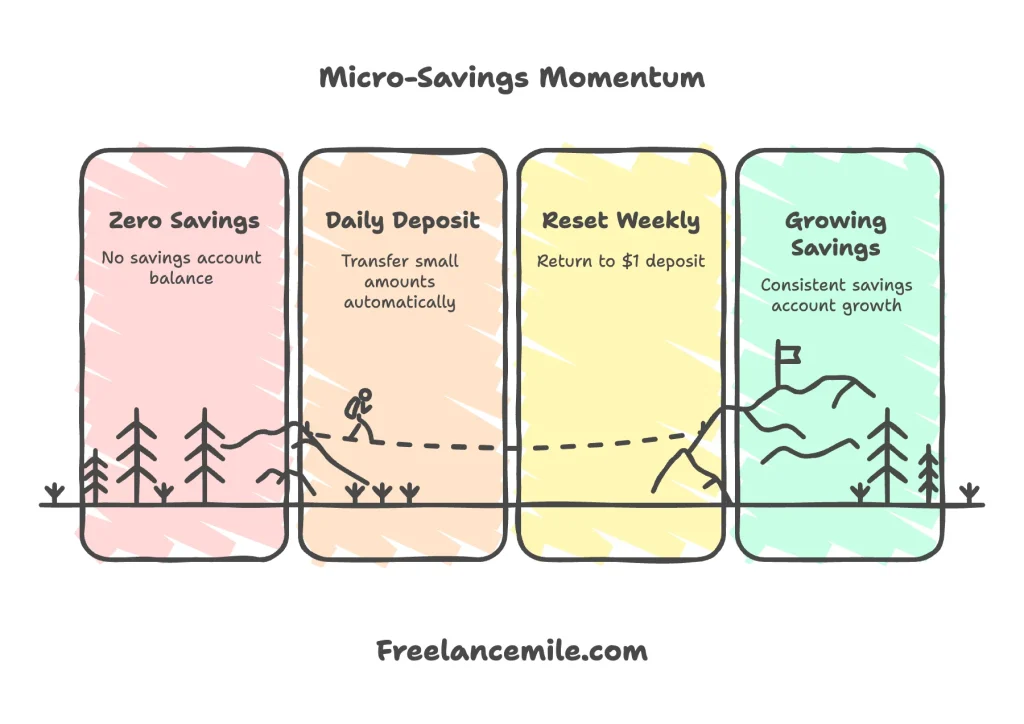

Week 1-4: Foundation Phase

Start with the dollar-a-day method, but make it even more manageable. Save $1 on Monday, $2 on Tuesday, $3 on Wednesday, then reset to $1 on Thursday.

This creates momentum without the overwhelm of constantly increasing amounts. Use your bank’s automatic transfer feature to move these tiny amounts into a separate savings account immediately after each deposit.

I suggest opening a high-yield savings account with Ally Bank or Marcus by Goldman Sachs for this challenge.

Both offer no minimum balance requirements and competitive interest rates—Ally at 3.50% APY and Marcus at 3.65% APY—which means your money actually grows while you’re saving it.

Week 5-12: Momentum Building

Once saving becomes automatic, gradually increase your weekly target. The key is consistency, not perfection.

During this phase, focus on finding your “leaky bucket” expenses—those small recurring charges that add up without you noticing. Check your bank statements for subscription services you forgot about.

The average American household wastes $204 per year on unused subscriptions. Identifying and canceling these forgotten services could contribute significantly to your emergency fund over time.

Week 13-26: Acceleration Phase

Now that you’ve proven to yourself that saving is possible, it’s time to get creative about increasing your income. As someone who works in digital marketing, I’ve seen countless people successfully launch side hustles that bring in an extra $200-500 per month.

The beauty of the gig economy is that you can start earning money immediately.

Whether it’s delivering food through DoorDash, selling items on Facebook Marketplace, or freelancing your existing skills, every extra dollar goes directly toward your emergency fund goal.

The Psychology Behind Successful Money Saving Challenges

Here’s what I’ve learned from studying consumer behavior: people who complete money saving challenges share one critical trait—they make their progress visible and celebrate small wins.

Your brain needs evidence that the sacrifice is working. Without visible progress, even the most disciplined person will eventually give up.

Create a visual tracker using a simple spreadsheet or even a paper chart on your refrigerator. Color in a square for every $25 you save, and you’ll have 40 squares to complete for your $1000 goal.

The dopamine hit from filling in that square triggers the same reward pathway that keeps people playing mobile games for hours. Use this psychological principle to your advantage.

Smart Spending Cuts That Actually Work

Forget about eliminating all fun from your life. Extreme budget cuts lead to extreme rebounds where you blow your entire emergency fund on a shopping spree.

Instead, focus on strategic reductions that barely impact your quality of life but free up significant money for saving.

The 30-Day Replacement Rule

Before buying anything over $30, wait 30 days. Write it down with the date, and if you still want it after the waiting period, buy it guilt-free.

This simple rule eliminated about $150 worth of impulse purchases from my monthly spending without feeling restrictive. Most items on that list become completely uninteresting after a few weeks.

The Generic Brand Challenge

Switch to generic versions of three products you buy regularly: paper towels, cleaning supplies, and over-the-counter medications. Great Value (Walmart’s brand) and 365 Everyday Value (Whole Foods) often provide identical quality at 30-40% less cost.

This isn’t about becoming an extreme couponer or eating ramen every meal. It’s about making strategic swaps that add up to real savings over time.

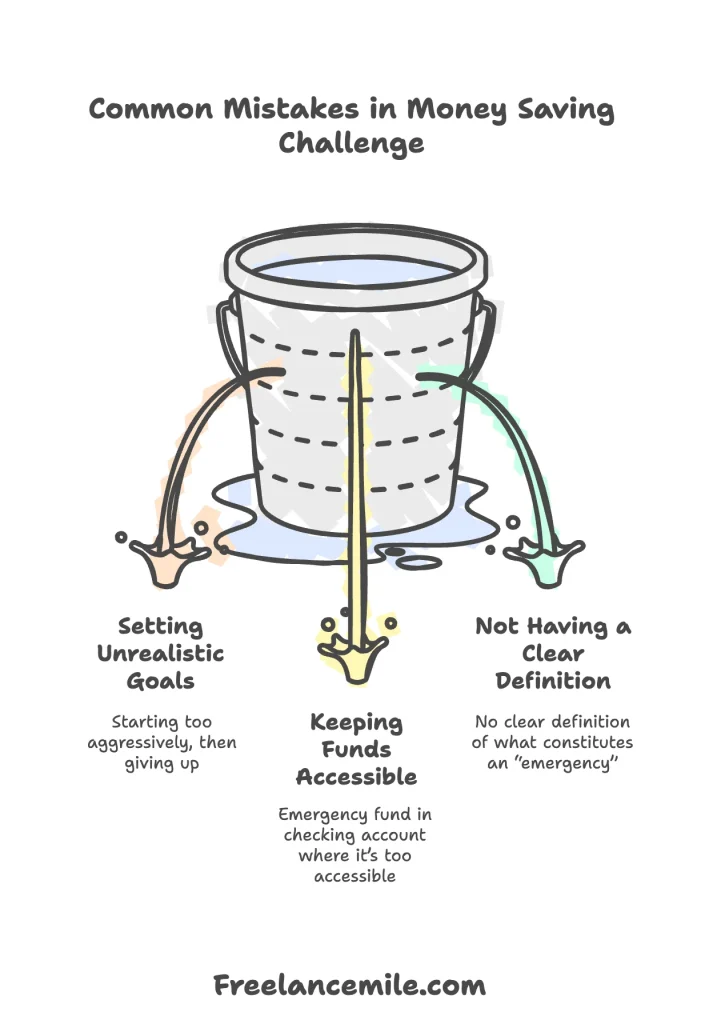

What Are the Most Common Money Saving Challenge Mistakes?

The most significant mistake people make is setting unrealistic goals that guarantee failure.

I’ve analyzed dozens of failed saving attempts, and they all follow the same pattern: starting too aggressively, then giving up entirely after missing a few days.

Your emergency fund challenge should feel almost boringly easy at first. If you’re struggling to hit your weekly target, you’re moving too fast.

Another common mistake is keeping your emergency fund in your checking account where it’s too accessible. The psychological barrier of transferring money back from savings to checking provides just enough friction to prevent impulse withdrawals.

The third mistake is not having a clear definition of what constitutes an “emergency.” Car repairs, medical bills, and job loss qualify as emergencies.

New shoes, vacation deals, and holiday gifts do not.

How Do You Maintain Your Emergency Fund Over Time?

Once you hit your $1000 goal, the challenge shifts from building the fund to protecting it. This is where many people stumble because they treat their emergency fund like a bonus checking account.

Set up automatic transfers to replenish the fund immediately after any withdrawal. If you use $300 for car repairs, that $300 should be back in your emergency fund within three months maximum.

Consider your first $1000 as the foundation, not the finish line. Numerous financial experts recommend 3-6 months of expenses in your emergency fund, which could be $5000-15000 for most people.

But don’t let that intimidate you. Focus on celebrating the $1000 milestone first, then gradually work toward larger goals as your income increases.

52 Week Money Saving Challenge Variations

The traditional 52-week challenge has you saving $1 in week one, $2 in week two, and so on until you’re saving $52 in the final week. That adds up to $1378 total, but the problem is that the largest amounts come during expensive holiday months.

Instead, try the reverse method: start with $52 in January when you’re motivated, then decrease the amount each week. By December, you’re only saving $1 per week when money is tightest.

Another variation that works well for irregular income is the percentage method. Save 1% of whatever money comes in that week, whether it’s $300 or $800. This automatically adjusts to your financial reality while maintaining the habit.

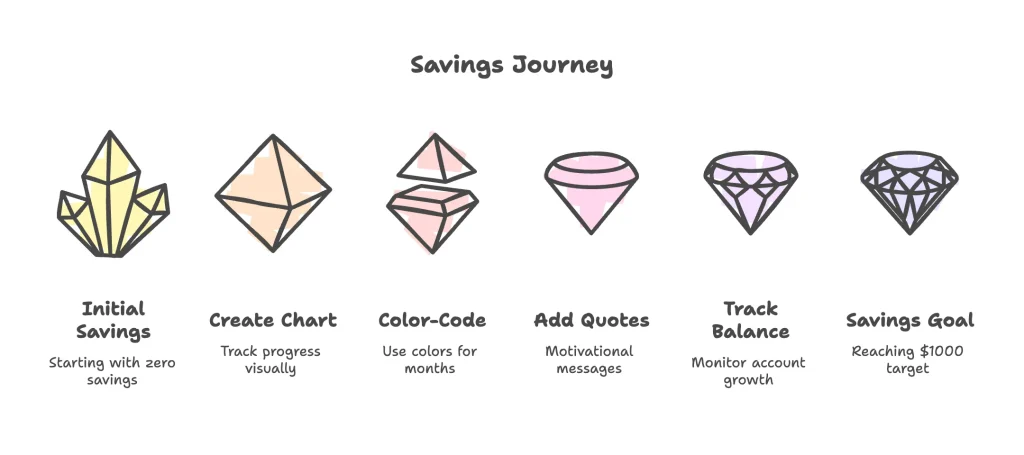

Your Money Saving Chart: Track Progress Like a Pro

Visual progress tracking isn’t optional—it’s the difference between success and giving up halfway through. Create a simple chart with 40 boxes representing $25 increments toward your $1000 goal.

Use different colors for different months, or add motivational quotes along the way. The key is making your progress impossible to ignore.

I used to keep a screenshot of my savings account balance as my phone wallpaper during challenges. Seeing that number increase every time I check my phone reinforces the positive behavior and keeps me motivated during tempting moments.

Pro tip: Share your progress on social media or with friends. Public accountability increases your completion rate by over 60% according to behavioral psychology research.

Advanced Saving Methods for Faster Results

Once you’ve mastered the basics, these advanced techniques can accelerate your progress significantly. The key is not trying all of them at once, but adding one new method every few weeks.

The Cashback Acceleration Method

Use a rewards credit card for all planned purchases, then immediately pay it off and transfer the cashback to your emergency fund.

The Chase Freedom Flex offers 5% cashback on rotating categories (up to $1,500 quarterly), 5% on Chase travel bookings, 3% on dining and drugstores, and 1% on everything else.

This method can add an extra $10-30 monthly to your savings without changing your spending habits. Just make sure you’re paying the full balance every month to avoid interest charges.

The Temperature Challenge

For every degree you adjust your thermostat toward energy savings, transfer $5 to your emergency fund. Set it to 68°F in winter instead of 72°F, or 76°F in summer instead of 72°F.

This gamifies both energy savings and emergency fund building. Your lower utility bills provide extra money for the challenge while the temperature adjustments become automatic habits.

Building Long-Term Financial Confidence

The real victory isn’t hitting $1000 in your savings account—it’s proving to yourself that you can take control of your financial future even when starting from nothing.

That confidence becomes the foundation for every other financial goal you’ll tackle.

Through my experience analyzing consumer behavior patterns, I’ve noticed that people who complete their first money saving challenge typically go on to achieve much larger financial milestones.

The skills you develop during this process—patience, consistency, visual tracking, and strategic thinking—transfer directly to investing, debt payoff, and wealth building.

Your $1000 emergency fund represents more than just money in the bank. It’s your declaration of independence from financial stress and your first step toward real financial security.

Stay tuned for more money saving challenges like this!