To invoice someone as a freelancer, you need to create a clear and detailed invoice outlining the services you’ve provided, the amount due, any taxes, the payment terms, and how the client can pay.

To ensure you’re well-equipped for this critical task and maintain a healthy cash flow, follow the detailed guide below which will encompass everything from utilizing a freelance invoice template to navigating late payments and employing an invoice generator. Learn how mastering invoicing can boost your freelance work and secure your financial stability.

Key Takeaways

- Understand and implement key components of a freelance invoice for successful billing.

- Choose among various invoicing tools that best suit your business needs and preferences.

- Highlight the significance of clear payment terms to avoid late payments.

- Leverage multiple payment options to make it easy for clients to pay you.

- Stay abreast of digital payment trends, such as cryptocurrency, to future-proof your invoicing process.

How to Invoice Someone as a Freelancer

As a freelancer, my professional invoicing process is the lifeline that maintains my business’s cash flow. Ensuring the inclusion of the right elements within my invoices guarantees their effectiveness and prompt payment from clients.

Through trial and error, I’ve identified keys to crafting an invoice that stands out and communicates my payment terms transparently.

Essential Elements of a Freelance Invoice & What to Include: Contact Information, Invoice Number, and More.

The essential elements of a freelance invoice include:

- Invoice Number or a Unique Identifier: Each invoice should have a unique identifier to differentiate it from other invoices and make it easier for the client to track payments.

- Your Company’s Details: Include your name, business name (if applicable), and contact information such as phone number and email address.

- Client’s Details: Add the client’s name, business name (if applicable), and contact information such as phone number and email address.

- Due Date: Specify the date the client is expected to pay the invoice.

- Breakdown of Services: Provide a detailed description of the services or products, including quantities, specifications, and prices.

- Amount Due Clearly state the total amount owed, including any applicable taxes and discounts.

- Payment Terms: Outline the payment methods accepted, due dates, & any late payment fees or penalties.

- Invoice Numbering and Tracking: Assign unique invoice numbers and implement a tracking system for efficient record-keeping and cash flow management.

- Additional Elements: Include additional information such as shipping details, tax information, or project milestones as needed.

- Design: Ensure the invoice is well-designed, readable, and reflects your brand identity.

These elements help ensure the invoice is clear, accurate, and professional, facilitating smooth transactions and prompt payments.

The Importance of a Clear Invoice Layout

A cluttered invoice is the enemy of prompt payment. That’s why the layout should be clear and accessible, allowing clients to easily locate every important detail from the payment option to the total amount due. A logically organized invoice notches up the professionalism, compelling clients to honor their commitments in a timely manner.

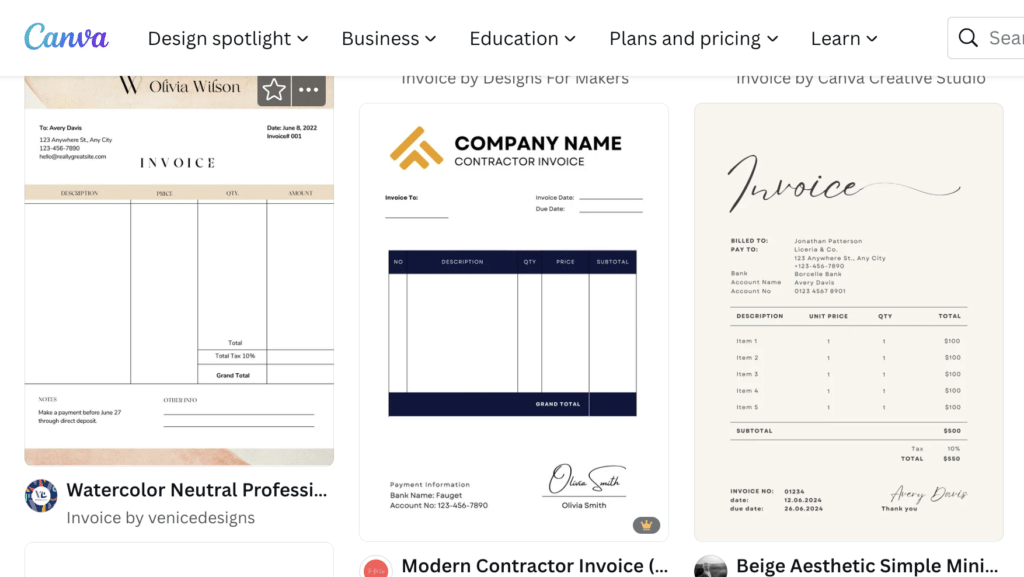

Canva Free Online Invoice Generator

Canva’s Free Online Invoice Generator has proven an invaluable tool for me. The platform helps me create invoices that are not only visually appealing but also embody the professional demeanor my freelance business strives for.

Below, I’ve laid out a table comparing a traditionally formatted invoice to one designed with Canva:

| Component | Traditional Invoice | Canva-Designed Invoice |

| Visual Appeal | Basic and Functional | Stylish and Modern |

| Ease of Use | Takes time to format correctly | Templates for quick customization |

| Clarity of Information | Dependent on personal layout skills | Pre-arranged for optimal clarity |

| Accessibility | Requires software like Microsoft Word | Accessible on any device with internet |

The table highlights the advantages of using an online tool to enhance the invoicing experience. Despite whichever method I choose, ensuring that all necessary information is included and presented in an unambiguous, orderly fashion remains my highest priority. This practice undoubtedly helps in maintaining a smooth invoicing process and securing my financial autonomy as a freelancer.

Choosing the Right Invoicing Tools and Software

As I navigate the freelancing landscape, I’ve come to realize the true power of an effective invoicing system. It’s not merely about documenting transactions; it’s about shaping the entire payment experience both for myself and my clients. A seamless invoicing tool can significantly enhance my administrative efficiency, freeing up more time to focus on what I’m passionate about—my freelance work.

Invoicing Templates vs. Professional Invoicing Software

Starting off, the readily available freelance invoice templates seemed like the ideal choice. They’re easy to use and quite effective for those just dipping their toes into freelancing. Whether it’s Google Docs or Sheets, these invoice templates allowed me to swiftly send out invoices without a financial investment. However, as my client base grew, I found these static templates to be somewhat limiting.

That’s when professional invoicing software came into the picture. I was looking for an invoicing tool that could handle the growing demands of my freelance business—from handling complex invoice templates with ease to sending out recurring invoices on autopilot.

The best professional freelancer invoicing software includes FreshBooks, Wave Invoicing, and Square Invoices. FreshBooks is the best overall choice, offering features like intuitive invoicing, time tracking, and weekday phone support. Wave Invoicing is the best option for free software, providing features like recurring invoices and automatic payment reminders. Square Invoices is the best for including contracts and integrating with Square’s all-in-one payment platform.

Benefits of Automated Recurring Invoices

Subscribing to an invoicing software has been a game-changer, particularly when it comes to recurring invoices. The automation of repetitive billing cycles has not only slashed my administrative workload but also minimized the errors that come with manual entries.

My clients appreciate the consistency and punctuality, and I can rest easy knowing that every month, the invoices will be sent out, and my payment terms enforced, without lifting a finger.

| Feature | Invoice Templates | Invoicing Software |

| Cost | Free or low-cost | Subscription-based, often with a free trial |

| Customization | Limited customization | Highly customizable layouts and fields |

| Automation | None | Email & SMS invoicing, recurring invoice automation |

| Integration | Manual | Direct integration with payment gateways |

| Payment Reminders | Manual sending required | Automated reminders and notifications |

| Reporting | Basic tracking in spreadsheets | Detailed financial reporting and analytics |

Making the switch to a dedicated invoicing tool was a strategic move to elevate my freelance business. It was about stepping up from the basics and adopting a system that aligns with the needs of a growing enterprise. By automating the least enjoyable part of my business—the paperwork—I’ve reclaimed precious time that’s better spent on client work and business development.

Getting Paid: Methods and Best Practices

As a freelancer, whether you’re into freelance writing, graphic design, or any other independent service, getting paid accurately and on time is the lifeblood of your business. It’s essential to establish robust payment terms and conditions from the get-go.

Clients should clearly understand when a payment is due, what payment options are available, and any fees associated with late payments. With the right approach, you can minimize the hassle of overdue invoices and maintain a steady cash flow.

Setting Up Payment Terms and Conditions

My experience has taught me that being upfront about payment conditions avoids confusion down the line. I typically specify my payment terms directly within my contracts, detailing the payment schedule, payment method, and the ramifications of late payments, including any late fee that might apply. This layer of upfront transparency helps cement a professional relationship and sets clear expectations.

Offering Multiple Payment Options

To make the payment process as convenient as possible for my clients, I always offer a variety of payment options. Many clients appreciate the flexibility of making card payments with their credit card or using electronic payment systems like PayPal or Google Pay. Here’s a breakdown of the payment methods I offer:

| Payment Method | Benefits | Best for |

| Credit Card | Fast and secure transactions. | Clients who prefer traditional payment. |

| PayPal | Convenient for international clients. | Freelance writing or designing with overseas customers. |

| Bank Transfer | No need for intermediary services. | Clients with corporate banking accounts. |

| Google Pay | Smooth mobile payments. | Mobile-savvy clients. |

The emerging trend of recurring payments has also been a game-changer for my routine services. It ensures that I get paid automatically on a schedule, which is a boon for my cash flow and lessens the worry about chasing down payments.

Ultimately, combining transparent payment conditions with a convenient array of payment options and methods leads to more satisfied clients and a healthier freelance business for me. It’s a best practice that I’ve woven into the fabric of my dealings, ensuring my freelance journey is as financially stable as possible.

Embracing the Digital Frontier in Freelancing

As I navigate through the evolving landscape of the freelance economy, I can’t help but recognize the revolutionary impact of cryptocurrency and blockchain technology. The freelance market is on the cusp of a seismic shift thanks to these digital currencies. My freelance invoice isn’t just a document; it’s a gateway to enter the digital frontier.

Accepting payments in cryptocurrency is not just a flashy trend; it’s becoming a necessary aspect of being a successful freelance writer or any freelancer in today’s market. By leveraging a crypto payment processor, I join an creative group of professionals who are shaping the future of freelancing. The use of cryptocurrencies comes with a promise of lower fees and expedited transfer times—crucial factors for maintaining cash flow and client satisfaction.

The implementation of smart contracts, fortified by the immutability of blockchain, has been a game-changer for ensuring secure and enforceable agreements between freelance clients and myself. This technology has fundamentally altered how I perceive and engage in contractual relationships, significantly reducing freelancer challenges related to payment defaults and disputes.

| Traditional Payment Systems | Cryptocurrency Payment Systems |

| Higher transaction fees | Low to minimal fees |

| Longer transfer times | Quick transfer times |

| Chargeback risks | Irreversible transactions |

| Bank-dependent operations | Decentralized and independent |

Staying ahead in this dynamic freelance market requires more than just awareness—it demands active participation. I make it a priority to understand the fluctuations in the cryptocurrency markets and engage with communities that are at the forefront of this digital wave. This helps me to align my pricing and services with the ongoing digital escalation.

With these unparalleled advances, I find myself chiseling a unique position within the freelance market. The future holds vast potential for those of us ready to harness the full capabilities of digital currencies and blockchain technology. It’s not just about keeping up with the times; it’s about paving the way for a new standard in the freelance economy. The digital frontier is not just knocking—it’s wide open.

Conclusion & Future Predictions in Freelance Invoicing

Future predictions in freelance invoicing and payment systems include the integration of AI-powered invoicing systems, the adoption of blockchain technology for security and transparency, the growth of mobile invoice approvals, enhanced supplier portals, localization, and global compliance, the use of cryptocurrency and peer-to-peer payment platforms, mobile payment solutions, cross-border payment innovations, and cashless payments.

Traditional payment providers will collaborate with fintechs and technology providers to foster innovation in the industry. These trends will shape the future of freelance invoicing and payment systems, ensuring greater efficiency, accuracy, and adaptability to the growing needs of businesses worldwide.

By crafting professional invoices that resonate with clients worldwide, I not only uphold the value of my work but also pave the way for a thriving, digital-first financial future within the freelancing sphere.