It took a $5 coffee—and a scary bank alert—for me to finally change my spending. Here’s how.

I was sipping my usual $5 iced coffee after a weekend trip to the local supermarket, feeling good about getting groceries on sale.

Everything was routine… until BLAM!

My phone dinged with a bank alert: my account was alarmingly low. I froze. On that hot August day (yes, 95°F outside), I realized small habits were quietly draining my budget.

At that moment, I remembered what consumer data I’d seen: only 46% of Americans even have 3 months of expenses saved, and nearly 1 in 4 have NO emergency fund at all.

If I was living paycheck-to-paycheck on a decent income, I thought, imagine those with less.

In my 12+ years in digital marketing, I’ve studied U.S. spending patterns (especially around Labor Day sales, holiday shopping madness, and back-to-school runs).

I’ve seen how little things add up. Now I’m sharing the seven practical tips that helped me—and can help you—save on a tight budget.

Think of it like a marketing campaign for your money: we set a goal and we stick to it! Ready to see results?

Let’s check them out!

In the next sections, I’ll break down each tip. First, a quick overview of what’s ahead:

- Track Every Dollar and Plan Your Budget. See exactly where your money goes (I once was shocked by weekly Starbucks runs I never logged!).

- Slash Recurring Bills and Luxuries. Cut the fat: cancel unused subscriptions, bundle services, and take a look at your cell, cable, and utility costs.

- Shop Smart at Grocery Stores. Meal plan, make lists from what’s in your pantry, and choose bulk/store brands to slash your food bill.

- Use Deals, Coupons & Apps. Never buy online (or in-store) without checking for coupon codes, cash-back apps or price matches. A few clicks can save big.

- Pay Yourself First (High-Yield Savings). Automate small savings from each paycheck into a no-fee high-interest account. Even $20 a week adds up with ~4% APY.

- Boost Income & Cut Debt. A little extra side gig money (even ~$200/mo) can build your cushion. And attack high-interest debt – it’s like a money leak if you ignore it.

- Tackle Energy and Transport. Swap to LED bulbs ($225/year saved), seal leaks, and gas-up strategically. Every degree on the thermostat and every MPG in your car count.

Each tip ends with a “Pro Tip” to put it into action. Let’s dive in!

🎬 Prefer to watch? Check out our quick video summary!

7 Quick Money Saving Tips

Track Every Dollar and Plan Your Budget

Start by writing down everything you spend. I mean it: every coffee, Uber ride, Amazon cart item, even that $1 tip.

In fact, Bank of America’s guide recommends recording every coffee and tip in a simple spreadsheet or app.

I once discovered I was buying three $3 Starbucks drinks a week and never logging them – that’s over $40 a month flying out unnoticed!

So here’s the formula I use: Spending App + Weekly Review + Goal = Control. Each payday I immediately categorize my fixed bills (rent, utilities, insurance) then set a realistic savings goal (even 5% of income).

What’s left becomes my “fun money.” This way I pay myself first. (Pro tip: use a zero-based budget – give every dollar a name, even if it goes to savings.) You might find, as I did, that the 50/30/20 rule works well: 50% needs, 30% wants, 20% savings.

It’s not glamorous, but sticking to a plan literally puts you in the driver’s seat.

Pro Tip: Look back at your bank/credit statements now. Highlight recurring charges and round-dollar purchases to spot leaks. You’ll thank yourself!

Slash Recurring Bills and Luxuries

Next, get ruthless with monthly subscriptions and recurring bills. I had a “set-it-and-forget-it” cable package and several streaming services I barely used.

One call to customer service got me a 30% discount, but ultimately I canceled cable entirely and switched to a $10 streaming bundle.

That alone saved $80 a month. According to Bank of America’s savings tips, cancel any membership you don’t use.

Turns out I was paying $15/mo for a gym membership I used twice a month – so I quit, saving $180 a year.

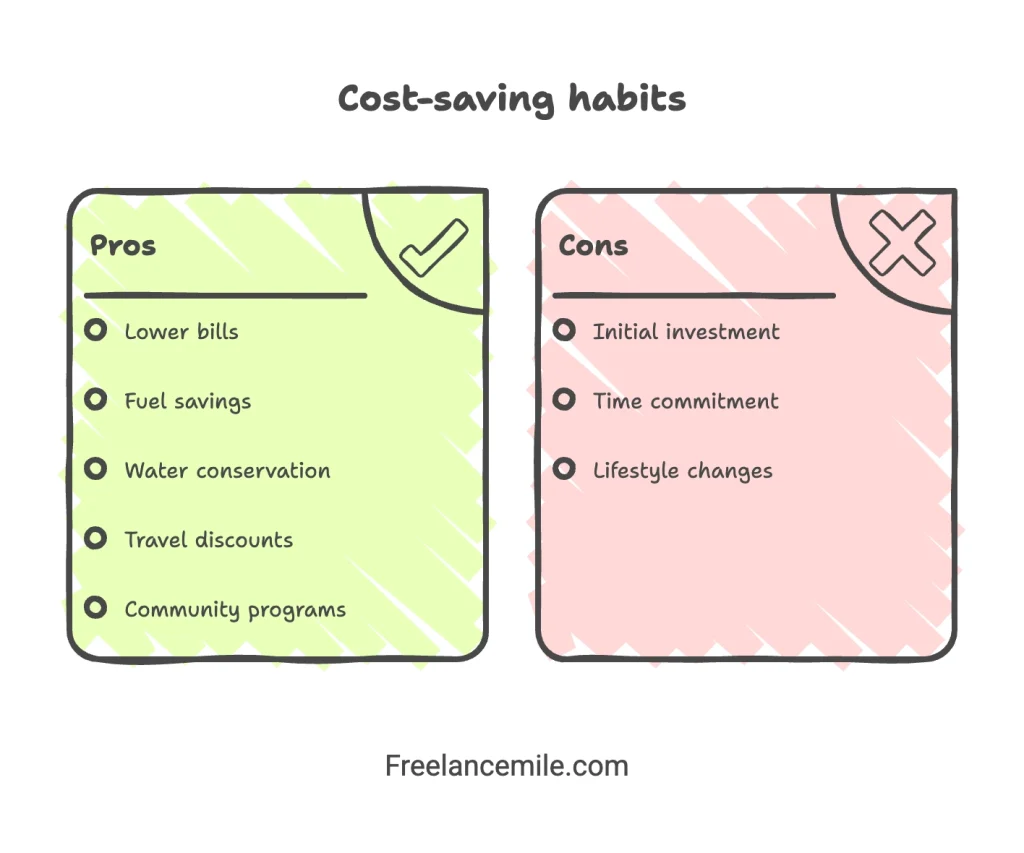

Utilities are another easy win. At home, my friend swapped all bulbs to LEDs ($3-$5 each at Home Depot) and his electric bill dropped noticeably.

The U.S. Department of Energy says the average household saves about $225 per year just by switching to LEDs.

You should also set your thermostat smartly: each degree above 72°F in summer saves ~3-5% on cooling (we kept fans on, too). On heating bills in winter, wearing an extra sweater indoors can save big bucks (each degree lower is ~3% savings).

Check if you qualify for assistance: many low-income families use the federal LIHEAP program to pay energy bills or weatherize homes.

For services like cell phone or internet, shop around. You can call your phone carrier and ask them to drop your monthly plan by $10 by bundling phone and Wi-Fi.

(My friend found a T-Mobile plan for $25/mo with 5G, which was a game-changer!) Insurance rates can also be negotiated – my friend compared auto quotes and saved $200/year by switching when he realized he was paying too much.

Pro Tip: Use your banking app’s budgeting tool. Some banks (Chase, Wells Fargo, Bank of America) have built-in trackers. And set calendar reminders for free-trial expirations or annual rate hikes on services you can cancel.

Shop Smart: Meal Plan and Compare Prices

Food is massive in our budgets – Ramsey Solutions notes it’s typically the third-highest expense for Americans.

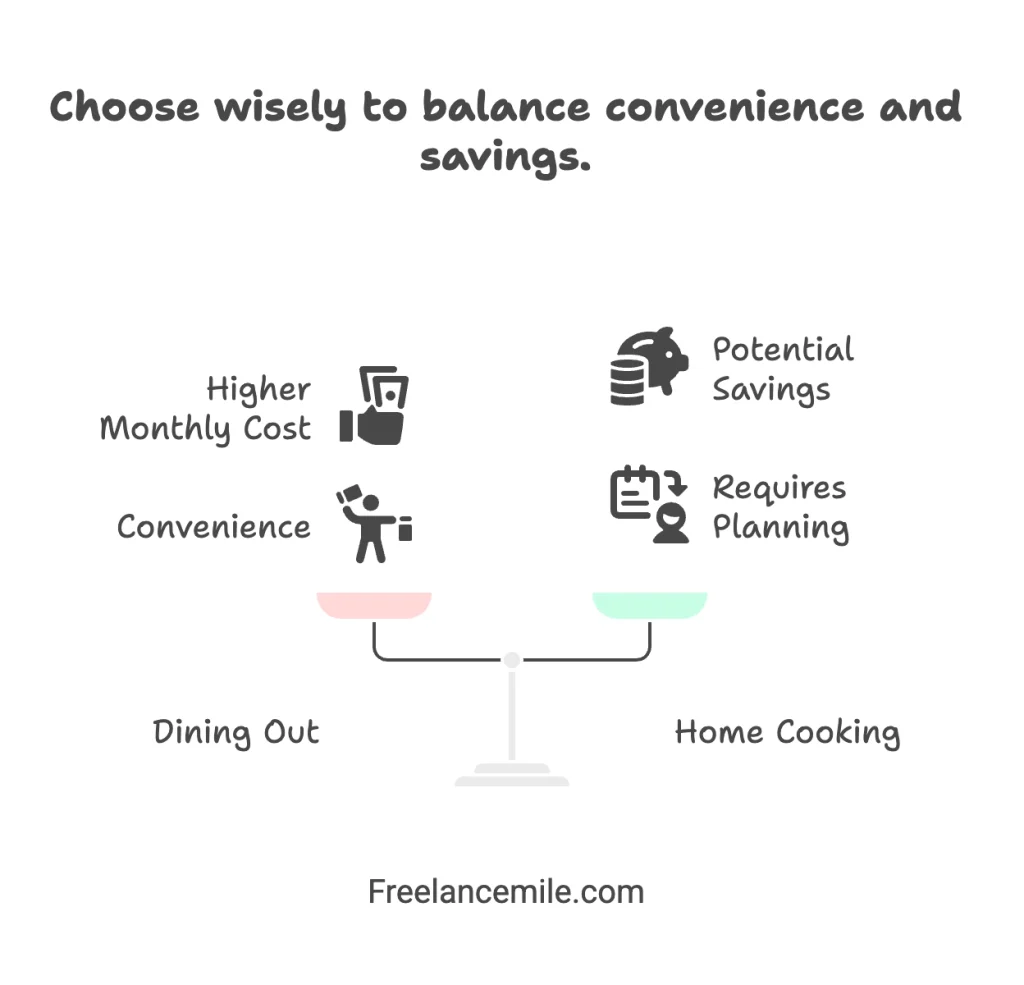

Believe me, I’ve faced that. Groceries and dining out can devour hundreds a month. The average American spends about $328/month eating out – think about redirecting even one of those takeout meals to your savings.

My secret weapon: meal planning and lists. Before each shopping trip, I survey my fridge and pantry. That way I only buy what I need.

Investopedia emphasizes this: start your shopping list by noting what you already have at home. I use a phone app or a photo of my fridge to plan.

This avoids buying extra vegetables or condiments that just sit around (Americans waste ~$473 billion of food each year by throwing out what they buy!).

While in the store, watch out for pricing tricks. Stores place expensive name brands at eye level.

Proven tip: look at top or bottom shelves for cheaper alternatives. I swapped my regular cereal and pasta for the store brand – same taste, about $2 less each.

Always check unit price (¢ per ounce) – bigger bags aren’t always cheaper by weight.

Warehouse clubs (Costco, Sam’s Club) could be a godsend: a $60 annual Costco membership will pay for itself in your first two bulk hauls (rotisserie chickens for $5, giant bag of frozen veggies for $10, etc.).

Pro Tip: Ask for price matching! Many chains (Walmart, Home Depot, Target) will match a competitor’s price if you show them. You could walk into Walmart with a Target ad and save $3 on a blender. Also, use apps like Flipp to scan local weekly ads before you go, so you know where the deals are.

Use Coupons, Cash-Back & Price Matching

Don’t skip this one – tech can pay you back. Browser extensions and apps will find discounts for you automatically. I never checkout online without letting tools do the work: Capital One Shopping (free) and PayPal Honey scan for promo codes on thousands of retailers.

Honey found a 10% off code for a laptop my friend was buying, saving $45. Even better, Target’s app and Kroger’s Fuel Perks can knock cents off each grocery/brewery run.

Couponing is far from embarrassing; it’s a money hack. For groceries and household items, I clip digital coupons on each store’s app before checkout.

Pro Tip: Pay with a cash-back credit card (just pay it off each month). For example, Chase Freedom Flex offers a good percentage of cash back on rotating categories, such as gas or groceries.

That’s literally extra money back in your pocket. Also, check out capitalone.com/marketplace or sites like Rakuten – they give 1-5% back on many purchases.

Pay Yourself First (High-Yield Savings)

Here’s a formula I live by: Automatic Transfer + High-Yield Account + Consistency = Stress-Free Savings. Each payday, I immediately funnel a set amount (even just $20-$50) into a separate savings account.

This “pay yourself first” approach means I save before I have any chance to spend it.

It’s easier than you think: use an online bank or credit union. Many online banks (Ally, Marcus, Discover) offer top rates (around 4% APY now) and no monthly fees.

You can switch your savings to one of these, watching your balance grow faster than in an old, low-interest account. In one year, the interest alone adds a surprising few extra dollars to your cushion.

From my experience, even $100 a month makes a difference.

Suppose you tucked away just $5 a day (that’s your Starbucks money!) – Nasdaq reports that skipping a $5 daily latte and investing it instead could turn $18,250 into about $26,729 over ten years. Mind-blowing, right?

Pro Tip: Automate it. Set up a recurring weekly or monthly transfer on payday. Also, round up purchases to the nearest $ if your bank offers it (Savings “Coin Jar” features).

Lastly, if your bank charges fees, switch. Many of us pay $10-$15/month fees unnecessarily; going online can eliminate that and keep more money working for you.

Boost Income and Manage Debt

Sometimes, the best way to save is to earn a bit more. Side hustles are huge in the US: about 27% of Americans now work a second job.

In 2025, the median side-hustle income was only about $200 per month, but on a lean budget, an extra $200 means groceries and bills paid.

I took on a few freelance gigs (digital marketing help, content marketing) – I easily made an extra $300 in a weekend project. That entire $300 got squirreled into savings.

You don’t need a ton of time: think rideshare (Uber/Lyft), food delivery, tutoring, or selling stuff online.

One friend of mine tutors algebra online for 10 hours a month at $25/hour – that’s $250 extra, no special degree needed.

Even a weekend weekend lawn-care gig or dog-walking could bring in a couple hundred a month. It adds up fast.

While you’re at it, tackle high-interest debt. Credit card interest is like a reverse savings: 20% APR is $0.20 out of every dollar you owe.

According to Bankrate, 33% of Americans have more credit card debt than savings. If that’s you, use your extra side-hustle cash to pay down cards. Even shaving $50 off a credit card balance can save you hundreds in interest over a year.

Pro Tip: Open a side gig savings account (even a simple PayPal or cash-back checking) and dump all extra earnings into it. Resist the temptation to spend and watch how quickly it builds. Also consider free skills training (YouTube, Coursera) to qualify for higher-paying gigs.

Tackle Energy & Transportation Costs

Finally, don’t ignore everyday habits. They may seem small but they add up.

For example, check tire pressure monthly and combine errands into one trip to save gas. In the U.S., gas prices vary wildly: it’s easy to save a couple bucks each fill-up by using a free app like GasBuddy to find the cheapest station near you.

My friend started refueling at Costco (unleaded for about $3.40/gal in his area, versus $3.79 elsewhere), and it’s saved him nearly $10 each tank.

Adjusting your thermostat just 1-2 degrees, doing DIY home maintenance (fix leaks, insulate), and turning off lights when not needed make a big dent.

Remember the DOE’s tip: sealing cracks and installing a smart thermostat can slash heating/cooling costs by hundreds a year. You can set your AC to 78°F when you’re home, and it cuts your bill by approximately $20 per month. It sounds small, but that’s $240 a year – and it will be totally worth it.

It’s all about forming small daily habits. Like packing water and snacks for road trips (avoiding $5 gas station drinks), using a programmable sprinkler timer, or air-drying clothes instead of running the dryer.

One quick win for you could be upgrading to a $25 mesh showerhead – it could save you about 30% on water bills.

Pro Tip: Look into community programs or discounts. In some states, electric companies or municipal water utilities offer rebates or free energy audits for low-income families.

And if you fly, use Southwest’s Wanna Get Away fares (often ~$49 one-way) and join Marriott Bonvoy to redeem free nights – that’s seriously bang for your buck on travel.

What Are the Most Common Money-Saving Mistakes?

Even with the best advice, we all slip up. In my experience, the biggest mistake is not tracking spending in the first place. Without that budget, you’re flying blind.

Another trap is living paycheck-to-paycheck without a plan – expecting to save $500/month when you really can only afford $50 leads to frustration. Remember: $50 now is better than $0 forever.

Impulsive purchases are killer. A sale sticker can make you believe you need something, but if it wasn’t on your list, it’s usually not saving you money.

I’ll admit: I once caught myself hoarding coupons for things we didn’t really need, thinking I was being frugal – the net effect was still overspending.

Also, avoid the “one-size-fits-all budget” trap. What works for your friend (50/30/20) might not work if you have student loans or support family. Adjust as needed.

Not keeping an emergency fund is another common error – it means one flat tire or medical co-pay and you’re back at square one. That’s why building even a tiny buffer (start with $500) was my non-negotiable first goal.

How Do You Maintain Your Money-Saving Motivation Over Time?

Sticking to these tips can be tough, so let’s tackle motivation. First, set clear goals. I framed savings goals like marketing campaigns: “Emergency Fund – $1,000” or “Vacation Trip – $300.”

Every time I hit a mini-goal, I’d allow a small treat (a fancy latte or a $10 movie night) to keep myself pumped. Celebrate wins – even if it’s just a “heck yes!” to yourself when you hit a target.

Second, make it visual and routine. I keep a chart on my fridge (yeah, I went old-school) tracking monthly spending against budget, turning savings into a small game. Simply seeing progress sparks excitement.

Another tactic: accountability. I text a friend once a week with my budget update and vice versa. We tease each other about those late-night Amazon binges – friendly peer pressure can be motivating!

And here’s a tip I learned from marketing psychology: focus on “enough,” not “deprivation.”

For example, I asked, “Do I really need that third streaming service?” If the answer was no, I felt proud for saying no, not sad. Framing it as “I’m in control of my money” (rather than “I’m missing out”) made a huge difference.

Pro Tip: Try a 30-day challenge. Say “no dining out” or “cook at home every day” for one month. Track the dollars saved and relish that boost in your account. And when plans change or you slip (it happens!), don’t give up.

Adjust and keep going. We’ve all been there – a small setback just means you’ll save a little more the next month.

Conclusion: Your Next Move

The biggest win here? You reclaim control of your money. Even on a tight budget, these tips stack up to serious savings. For example, cutting just $10/day on casual spending (like coffee or snacks) adds up to $300 a month – almost $4,000 a year!

That’s financial security you wouldn’t have had otherwise.

Remember, the goal isn’t perfection; it’s progress. With these money saving tips, you’ll pay off debt faster, grow an emergency fund, and maybe even stash enough for that dream vacation. The key is consistency and being honest with yourself about priorities.

And hey, this is only the beginning. Stay tuned more posts like this!

Till then, keep implementing these steps and watch your “zero dollars” days start to feel awesome. You’ve got this!